Perak sebagai pelaburan

Tolong bantu menterjemahkan sebahagian rencana ini. Rencana ini memerlukan kemaskini dalam Bahasa Melayu piawai Dewan Bahasa dan Pustaka. Sila membantu, bahan-bahan boleh didapati di Silver as an investment (Inggeris). Jika anda ingin menilai rencana ini, anda mungkin mahu menyemak di terjemahan Google. Walau bagaimanapun, jangan menambah terjemahan automatik kepada rencana, kerana ini biasanya mempunyai kualiti yang sangat teruk. Sumber-sumber bantuan: Pusat Rujukan Persuratan Melayu. |

Perak, seperti logam berharga lain, dapat digunakan sebagai pelaburan. Untuk lebih daripada seribu tahun, perak telah dianggap suatu bentuk wang dan simpanan nilai. Bagaimanapun, sejak berakhirnya piawai perak, perak telah kehilangan peranannya sebagai wang sah di Amerika Syarikat. (Ia terus digunakan dalam syiling sepuluh sen dan lima belas sen hingga 1964, dan lima puluh sen hingga 1970 apabila nilai intrinsik perak mengambil alih nilai muka duit syiling.) Pada 2009, permintaan utama perak adalah daripada kegunaan industri (40%), barang kemas, syiling bulion dan produk pertukaran bursa.[1]

Harga perak[sunting | sunting sumber]

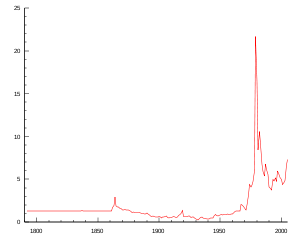

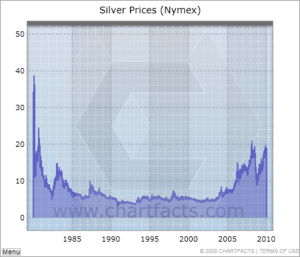

Harga perak secara terkenal tidak stabil kerana ia dapat menurun naik di antara industri dan simpanan kemahuan nilai. Pada waktu ini dapat menyebabkan penilaian linkungan dalam pasar, mencipta ketidakstabilan.

Perak sering menjejaki harga emas oleh kerana dengan simpanan kemahuan nilai, walaupun nisbah dapat berbeza. Nisbah emas/perak sering dianalisiskan oleh para pedagang, pelabur dan pembeli. Pada 1792, nisbah emas/perak telah ditetapkan oleh undang-undang di Amerika Syarikat pada kadar 1:15,[2] yang bermakna bahawa satu auns troy emas akan membeli 15 auns troy perak; suatu nisbah 1:15.5 telah digubalkan di Perancis pada 1803.[3] Sesungguhnya, pukul rata nisbah emas/perak ketika abad ke-20 adalah 1:47.[4] Semakin kurangnya nisbah/bilangan, perak adalah lebih mahal berbanding emas. Sebaliknya lebih tinggi nisbah/bilangan, lebih murah perak berbanding dengan emas.

| Tahun | Harga perak (pukul rata longgokan tahunan[5]) AS$/ozt |

Harga emas (pukul rata longgokan tahunan[6]) AS$/ozt |

Nisbah emas/perak |

|---|---|---|---|

| 1840 | 1.29 | 20 | 15.5 |

| 1900 | 0.64 | 20 | 31.9 |

| 1920 | 0.65 | 20 | 31.6 |

| 1940 | 0.34 | 33 | 97.3 |

| 1960 | 0.91 | 35 | 38.6 |

| 1970 | 1.63 | 35 | 22.0 |

| 1980 | 16.39 | 612 | 37.4 |

| 1990 | 4.06 | 383 | 94.3 |

| 2000 | 4.95 | 279 | 56.4 |

| 2005 | 7.31 | 444 | 60.8 |

| 2009 | 14.67 | 972 | 66.3 |

| 2010 (thru May 29) | 17.44 | 1135 | 65.1 |

Dari September 2005 seterusnya, harga perak telah naik secara agak curam, yang pada mulanya berada di sekitar $7 tiap auns troy tetapi mencapai $14 tiap ozt untuk kali pertama pada lewat 2006. Harga pukul rata bulanan perak adalah $12.61 tiap auns troy sewaktu April 2006, dan harga spot adalah ;lebih kurang $15.78 tiap auns troy pada November 6, 2007. Pada Mac 2008, ia hovered around $20 per auns troy.[7] Meskipun, harga perak jatuh menjunam sebanyak 58% pada Oktober 2008, bersama dengan logam lain dan komoditi, oleh kerana kesan kerap-kerup kredit.[8]

Fakta mempengaruhi harga perak[sunting | sunting sumber]

- Pelabur swasta dan institusi

- Dari 1973 Hunt brothers bermula cornering the market dalam perak, membantuk untuk menyebabkan suatu tikaman pada 1980 $49.45 tiap auns troy dan pengurangan nisbah emas/perak bawah ke 1:17.0 (emas juga memuncak pada 1980, di $850 tiap auns troy).[9] Pada lewat sembilan bulan 1979, adik-beradik telah dianggarkan memegang melebihi 100 juta auns troy perak dan beberap kontrak hadapan perak besar troy.[10] Meskipun, suatu penggabungan peraturan perdagangan diubah pada New York Mercantile Exchange (NYMEX) dan pengantaraan Federal Reserve menamatkan permainan ini.

- Pada 1997, Warren Buffett membeli 130 juta auns troy (4,000 ton metrik) perak di lebih kuranf $4.50 tiap auns troy (jumlah harga $585 juta). Pada Mei 6, 2006, Buffett mengumumkan pada para pemegang saham bahawa syarikatnya tidak lagi memegang perak.

- Pada April 2006 iShares melancarkan dana dagang tukaran perak, digelar iShares Silver Trust (NYSE: SLV), yang pada April 2008 memegang 180 juta auns troy perak sebagai simpanan.

- The large concentrated short position

- The CFTC publishes a weekly Commitments of Traders Report which shows that the four or fewer largest traders are holding 90% of all short silver contracts. Furthermore, these four or fewer traders were short a total of 245 million troy ounces (as of April 2007), which is equivalent to 140 days of production. According to Ted Butler, one of these banks with large silver shorts, JP Morgan Chase, is also the custodian of the SLV silver ETF. Some silver analysis has pointed to a potential conflict of interest, as close scrutiny of Comex documents reveals that ETF shares may be used to 'cover' Comex physical metal deliveries. This leads analysts to speculate that some stores of silver have multiple claims upon them. On 2008-09-25 the CFTC relented and probed the silver market after persistent complaints of foul play.[11] On September 1, 2010, Bloomberg reported that JP Morgan Chase will be closing their Proprietary Trading Desk.[12]

- Industrial demand

- The use of silver in items such as electrical appliances (silver is the highest known conductor of electricity), photovoltaics (one of the highest reflectors of light), clothing and medical uses (silver has antibacterial properties) has increased since 2001. New applications for silver are also being explored in batteries, superconductors and microcircuits, which may further increase non-investment demand. The expansion of the middle classes in emerging economies aspiring to Western lifestyles and products may also contribute to a long-term rise in industrial usage.[13] Even so, due to the advent of digital cameras the enormous reduction in the use of silver halide-based photographic film has tended to offset this.[perlu rujukan]

Kenderaan pelaburan[sunting | sunting sumber]

Batang[sunting | sunting sumber]

A traditional way of investing in silver is by buying actual bullion bars. In some countries, like Switzerland and Liechtenstein, bullion bars can be bought or sold over the counter at major banks.

Physical silver, such as bars or coins, may be stored in a home safe, a safe deposit box at a bank, or placed in allocated (also known as non-fungible) or unallocated (fungible or pooled) storage with a bank or dealer. Silver is traded in the spot market with the code "XAG". When settled in USD, the code is "XAGUSD".

Various sizes of silver bars:

- 1000 oz troy bars – These bars weigh about 68 pounds avoirdupois (31 kg) and vary about 10% as to weight, as bars range from 900 ozt to about 1,100 ozt (28 to 34 kg). These are COMEX and LBMA good delivery bars.

- 100 ozt bars – These bars weigh 6.8 pounds (3.11 kg) and are among the most popular with retail investors. Popular brands are Engelhard and Johnson Matthey. Those brands cost a bit more, usually about 40 cents to 2.00 dollars per troy ounce above the spot price, but that price may vary with market conditions.

- Odd weight retail bars – These bars cost less and generally have a wider spread, due to the extra work it takes to calculate their value and the extra risk due to the lack of a good brand name.

- 1 kilogram bars (32.15 ozt)

- 10 ozt bars and 1 ozt bars (311 and 31.1 g)

Duit syiling dan bulatan[sunting | sunting sumber]

Buying silver coins is another popular method of physically holding silver. One example is the 99.99% pure Canadian Silver Maple Leaf. Coins may be minted as either fine silver or junk silver, the latter being older coins with a smaller percentage of silver. U.S. coins 1964 and older (half dollars, dimes, and quarters) are 25 grams per dollar of face value and 90% silver (22½ g silver per dollar). (All 1965-1970 and one half of the 1975-1976 Bicentennial San Francisco proof and mint set Kennedy half dollars are "clad" in a silver alloy and contain just under one half of the silver in the pre-1965 issues.)

Junk-silver coins are also available as sterling silver coins, which were officially minted until 1919 in the United Kingdom and Canada and 1945 in Australia. These coins are 92.5% silver and are in the form of (in decreasing weight) Crowns, Half-crowns, Florins, Shillings, Sixpences, and threepence. The tiny threepence weighs 1.41 grams, and the Crowns are 28.27 grams (1.54 grams heavier than a US $1). Canada produced silver coins with 80% silver content from 1920 to 1967.

Other hard money enthusiasts use .999 fine silver rounds as a store of value. A cross between bars and coins, silver rounds are produced by a huge array of mints, generally contain a troy ounce of silver in the shape of a coin, but have no status as legal tender. Rounds can be ordered with a custom design stamped on the faces or in assorted batches.

Dana dagang penukaran[sunting | sunting sumber]

Silver exchange-traded funds represent a quick and easy way for an investor to gain exposure to the silver price, without the inconvenience of storing physical bars. Silver ETFs include:

- Central Fund of Canada (Templat:Tsx2, NYSE: CEF), which has 45% of its reserves physically held in silver with the remainder invested in gold.

- iShares Silver Trust (NYSE: SLV), launched in April 2006 by iShares. The fund invests exclusively in physical silver.

- In September 2006 ETF Securities launched ETFS Silver (BSL: SLVR), which tracks the DJ-UBS Silver Sub-Index, and later in April 2007 ETFS Physical Silver (BSL: PHAG), which is backed by allocated silver bullion. In July 2009, ETF Securities launched ETFS Silver Trust (NYSE: SIVR) in New York.

Sijil[sunting | sunting sumber]

A silver certificate of ownership can be held by investors instead of storing the actual silver bullion. Silver certificates allow investors to buy and sell the security without the difficulties associated with the transfer of actual physical silver. The Perth Mint Certificate Program (PMCP) is the only government-guaranteed silver-certificate program in the world.

The U.S. dollar has been issued as silver certificates in the past, each one represented one silver dollar payable to the bearer on demand. The notes were issued in denominations of $10, $5, and $1 and can no longer be redeemed for silver.

Akaun[sunting | sunting sumber]

Most Swiss banks offer silver accounts where silver can be instantly bought or sold just like any foreign currency. Unlike physical silver, the customer does not own the actual metal but rather has a claim against the bank for a certain quantity of metal. Digital gold currency providers, such as GoldMoney, and internet bullion exchanges, such as BullionVault, offer silver as an alternative to gold.

Derivatif, CFDs dan judi tersebar[sunting | sunting sumber]

Derivatives, such as silver futures and options, currently trade on various exchanges around the world. In the U.S., silver futures are primarily traded on COMEX (Commodity Exchange), which is a subsidiary of the New York Mercantile Exchange. In November 2006, the National Commodity and Derivatives Exchange (NCDEX) in India introduced 5 kg silver futures.[14]

Firms such as Cantor Index, CMC Markets, IG Index and City Index, all from the UK, provide contract for difference (CFD) or spread bets on the price of silver.

Syarikat perlombongan[sunting | sunting sumber]

These do not represent silver at all, but rather are shares in silver mining companies. Companies rarely mine silver alone, as normally silver is found within, or alongside, ore containing other metals, such as tin, lead, zinc or copper. Therefore shares are also a base metal investment, rather than solely a silver investment. As with all mining shares, there are many other factors to take into account when evaluating the share price, other than simply the commodity price. Instead of personally selecting individual companies, some investors prefer spreading their risk by investing in precious metal mining mutual funds.

Sistem percukaian[sunting | sunting sumber]

- Lihat juga: Sistem percukaian logam berharga

Dalam banyak rejim cukai, perak tidak memegang kedudukan khas yang sering dimampukan pada emas. Contohnya, dalam Kesatuan Eropah perdangan duit syiling emas yang diperakui dan produk bullion adalah pengecualian VAT, tetapi tiada kebenaran yang sama diberikan pada perak. Ini membuatkan cukai dalam duit syiling perak atau bullion kurang menarik untuk pelabur swasta, oleh kerana premium tambahan pada pembelian diwakili oleh VAT yang tidak dapat dipulih VAT (dikenakan bayaran di 17.5% di United Kingdom dan 19% untuk batang dan 7% untuk produk bullion dengan nilai muka, contohnya US Silver Eagle dan Maple Leaf, di Jerman).

Cukai lain seperti cukai keuntungan modal dapat digunakan untuk individu tergantung pada negara kediaman (kedudukan cukai) dan sama ada aset dijual di nilai yang ditambah.

Lihat juga[sunting | sunting sumber]

Rujukan[sunting | sunting sumber]

- ^ "Supply & Demand". The Silver Institute. Dicapai pada 2010-09-29.

- ^ http://www.constitution.org/uslaw/coinage1792.txt

- ^ http://www.dani2989.com/gold/goldsirverratio180027092004gb.htm

- ^ http://www.dani2989.com/gold/ratiogoldsilvergb030105.htm

- ^ "London Fix Historical Silver".

- ^ "London Fix Historical Gold".

- ^ http://www.kitco.com/charts/livesilver.html

- ^ "salinan arkib". Diarkibkan daripada yang asal pada 2014-04-23. Dicapai pada 2010-09-19.

- ^ "salinan arkib". Diarkibkan daripada yang asal pada 2008-10-28. Dicapai pada 2010-09-19.

- ^ http://silverbearcafe.com/private/01.09/circlek.html Diarkibkan 2012-05-10 di Wayback Machine H.L. Hunt and the Circle K Cowboys

- ^ Cui, Carolyn (September 25, 2008). "CFTC Relents and Probes Silver Market". The Wall Street Journal.

- ^ http://www.bloomberg.com/news/2010-08-31/jpmorgan-is-said-to-shut-proprietary-trading-to-comply-with-volcker-rule.html JPMorgan Said to End Proprietary Trading to Meet Volcker Rule

- ^ [1]

- ^ [2]

Pautan luar[sunting | sunting sumber]

- The Silver Institute

- Current London Silver Fixing Diarkibkan 2014-02-09 di Wayback Machine by the London bullion market

- Interactive Java Applet "Historic Volatility of the Silver Price Diarkibkan 2010-05-11 di Wayback Machine"