Kad debit

| Kewangan peribadi |

|---|

|

| Kredit · Hutang |

| Kontrak pekerjaan |

| Persaraan |

| Anggaran peribadi |

| See also |

Kad debit (juga dikenali sebagai kad bank, kad plastik atau kad cek) adalah kad pembayaran plastik yang boleh digunakan sebagai ganti wang tunai semasa membuat pembelian. Ia serupa dengan kad kredit, tetapi tidak seperti kad kredit, wang tersebut segera dipindahkan terus dari akaun bank pemegang kad ketika melakukan transaksi.

Sebilangan kad mungkin membawa nilai tersimpan yang digunakan untuk pembayaran, sementara sebilangan besar menyampaikan pesanan ke bank pemegang kad untuk menarik dana dari akaun bank yang ditentukan oleh pembayar. Dalam beberapa kes, nombor akaun utama diberikan secara eksklusif untuk digunakan di Internet dan tidak ada kad fizikal.

Di banyak negara, seperti kebanyakan Eropah Barat, penggunaan kad debit menjadi sangat meluas sehingga jumlahnya telah mengatasi atau menggantikan cek dan, dalam beberapa keadaan, transaksi tunai. Perkembangan kad debit, tidak seperti kad kredit dan kad caj, secara amnya khusus mengikut negara sehingga menghasilkan sejumlah sistem yang berlainan di seluruh dunia, yang sering tidak berseiring. Sejak pertengahan tahun 2000-an, sejumlah inisiatif telah membenarkan kad debit yang dikeluarkan di satu negara digunakan di negara lain dan membenarkan penggunaannya untuk pembelian dalam internet dan telefon.

Kad debit biasanya juga membolehkan pengeluaran wang segera, bertindak sebagai kad ATM untuk tujuan ini. Penjual juga boleh menawarkan kemudahan pengembalian wang tunai kepada pelanggan, sehingga pelanggan dapat mengeluarkan wang tunai bersama dengan pembelian mereka.

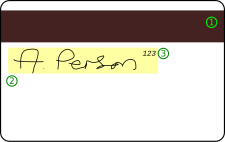

Jenis sistem kad debit[sunting | sunting sumber]

- Jalur magnet

- Jalur panel tandatangan

- Kod Keselamatan Kad

Terdapat tiga cara untuk memproses transaksi kad debit: EFTPOS (juga dikenali sebagai debit dalam talian atau debit PIN), debit luar talian (juga dikenali sebagai debit tandatangan), dan Sistem Kad Dompet Elektronik.[1] Sekeping kad fizikal boleh merangkumi fungsi ketiga-tiga jenis, sehingga dapat digunakan dalam beberapa keadaan yang berbeza.

Sistem debit dalam talian[sunting | sunting sumber]

Kad debit dalam talian memerlukan kebenaran elektronik untuk setiap transaksi dan debit tersebut akan segera ditunjukkan dalam akaun pengguna. Urus niaga tersebut juga dijamin dengan sistem pengesahan (PIN); beberapa kad dalam talian memerlukan pengesahan sedemikian untuk setiap transaksi, yang pada dasarnya menjadi kad mesin juruwang automatik (ATM) yang dipertingkatkan kegunaannya.

Satu kesukaran menggunakan kad debit dalam talian adalah keperluan peranti kebenaran elektronik di titik jualan (POS) dan kadang-kadang juga PINpad yang terpisah untuk memasukkan PIN, walaupun ini menjadi perkara biasa untuk semua transaksi kad di banyak negara.

Secara keseluruhan, kad debit dalam talian pada umumnya dilihat lebih unggul daripada kad debit luar talian kerana sistem pengesahan dan status langsung yang lebih selamat, yang mengurangkan masalah dengan kelewatan memproses transaksi yang mungkin hanya mengeluarkan kad debit dalam talian. Beberapa sistem debit dalam talian juga menggunakan proses pengesahan normal perbankan Internet untuk menyediakan transaksi debit dalam talian masa nyata.

Sistem debit luar talian[sunting | sunting sumber]

Kad debit luar talian mempunyai logo kad kredit utama (contohnya, Visa[2] atau MasterCard) atau kad debit utama (contohnya, Maestro di United Kingdom dan negara lain, tetapi tidak di Amerika Syarikat) dan digunakan di titik jualan seperti kad kredit (dengan tandatangan pembayar). Jenis kad debit ini mungkin dikenakan had harian, dan/atau had maksimum sama dengan baki akaun semasa/cek dari mana ia mengeluarkan dana. Transaksi yang dilakukan dengan kad debit luar talian memerlukan 2-3 hari untuk dilihat pada baki akaun pengguna.

Sistem kad dompet elektronik[sunting | sunting sumber]

Sistem dompet elektronik berasaskan kad pintar (di mana nilainya disimpan pada cip kad, bukan dalam akaun yang direkodkan secara luaran, maka mesin yang menerima kad tersebut tidak memerlukan sambungan rangkaian) digunakan di seluruh Eropah sejak pertengahan 1990-an, terutama di Jerman (Geldkarte), Austria (Quick Wertkarte), Belanda (Chipknip), Belgia (Proton), Switzerland (CASH) dan Perancis (Moneo, yang biasanya dibawa dengan kad debit). Di Austria dan Jerman, hampir semua kad bank semasa sekarang merangkumi dompet elektronik, sedangkan dompet elektronik baru-baru ini dihapuskan di Belanda.

[2]Kad debit prabayar[sunting | sunting sumber]

Kad debit prabayar boleh diiisi semula dan juga boleh dipanggil kad debit yang boleh diisi semula.

Pasaran utama kad debit prabayar secara tradisinya adalah orang yang tidak berbank;[3] iaitu orang yang tidak menggunakan bank atau kesatuan kredit untuk transaksi kewangan mereka.[4] Tetapi kad prabayar juga menarik pengguna lain yang tertarik dengan kelebihan ini.

Kelebihan kad debit prabayar termasuk lebih selamat daripada membawa wang tunai, berfungsi di seluruh dunia kerana penerimaan pedagang Visa dan MasterCard, tidak perlu bimbang membayar bil kad kredit atau berhutang, peluang bagi sesiapa yang berumur 18 tahun ke atas untuk memohon dan diterima tanpa mengambil kira kualiti kredit, dan pilihan untuk secara langsung memasukkan gaji dan faedah kerajaan ke dalam kad secara percuma.[5]

Walau bagaimanapun, sekiranya penyedia kad menawarkan laman web yang tidak selamat untuk membiarkan anda memeriksa baki kad, ini dapat memberi penyerang akses melihat maklumat kad.[6] Sekiranya pengguna kehilangan kad, dan mungkin tidak mendaftarkannya, pengguna kemungkinan akan kehilangan wang. Sekiranya penyedia mempunyai masalah teknikal, wang tersebut mungkin tidak dapat diakses ketika pengguna memerlukannya. Sistem pembayaran sesetengah syarikat nampaknya tidak menerima kad debit prabayar.[7] Terdapat juga risiko bahawa penggunaan kad debit prabayar secara produktif dapat menyebabkan syarikat penyedia data salah mengkategorikan pengguna dengan cara yang tidak diingini.[8]

Akses kewangan[sunting | sunting sumber]

Kad debit dan kad kredit selamat adalah popular di kalangan pelajar kolej yang belum mempunyai sejarah kredit. Kad debit juga boleh digunakan oleh pekerja ekspatriat untuk menghantar wang pulang ke keluarga mereka yang memegang kad debit gabungan.

Pembelian internet[sunting | sunting sumber]

Kad debit juga dapat digunakan di Internet dengan atau tanpa menggunakan PIN. Urus niaga internet boleh dilakukan dalam mod dalam talian atau luar talian, walaupun kedai yang menerima kad hanya dalam talian jarang berlaku di beberapa negara (seperti Sweden), sementara itu biasa di negara lain (seperti Belanda). Sebagai perbandingan, PayPal menawarkan pelanggan untuk menggunakan kad Maestro hanya dalam talian jika pelanggan memasukkan alamat tempat tinggal Belanda, tetapi tidak jika pelanggan yang sama memasukkan alamat tempat tinggal Sweden.

Lihat juga[sunting | sunting sumber]

Rujukan[sunting | sunting sumber]

- ^ Martin, Andrew (January 4, 2010). "How Visa, Using Card Fees, Dominates a Market". The New York Times. Dicapai pada 2010-01-06.

- ^ a b Ralko, Joe (2012-03-26). "Automated Teller Machines". Encyclopedia of Saskatchewan. Canadian Plains Research Center, University of Regina. Diarkibkan daripada yang asal pada 2017-09-29. Dicapai pada 2012-12-30.

- ^ "Pepper Prepaid Preport Extract" (PDF). PEPPER. Diarkibkan daripada yang asal (PDF) pada 2012-01-30. Dicapai pada 2012-04-09.

- ^ Perine, Martha. "Reaching the Unbanked and Underbanked". Stlouisfed.org. Diarkibkan daripada yang asal pada 2013-11-03. Dicapai pada 2012-12-30.

- ^ CreditCards.com (2006-03-22). "Prepaid debit card benefits and disadvantages". Creditcards.com. Dicapai pada 2012-12-30.

- ^ OneVanilla.com in your browser address bar might not show up as secure.

- ^ An Amtrak onboard ticket purchase several years ago was one case where a prepaid card was not accepted.

- ^ "A Study on Debit Cards" (PDF). www.indusedu.org (dalam bahasa Inggeris). Dicapai pada 2020-05-05.